Earlier today, the House of Representatives approved a $400 billion appropriations package. Unlike the stimulus package, which had no earmarks proposed by members of the House and Senate, this bill has a lot of them, as most routine appropriations bills do. Some reports suggest there are around 9,000 of them.

Whether or not you think earmarks are necessary to get federal money to worthy projects or unnecessary pork to grease the palms of supporters--and there are probably plenty of examples of both--the fact is that they are there, and our representatives are pretty good at securing them.

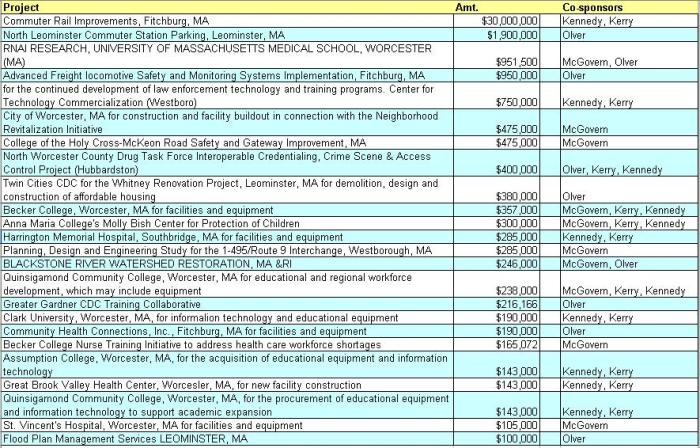

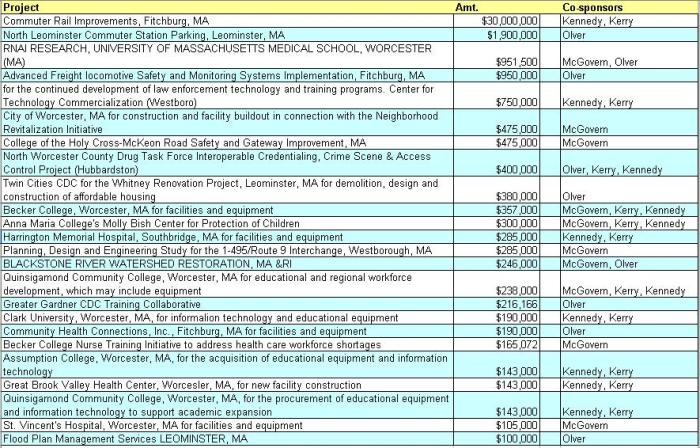

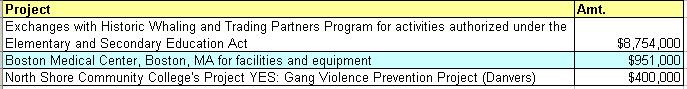

Central Massachusetts looks to make out pretty nicely. Here is a list of the projects that will affect communities here in Worcester County:

The Twin Cities look to do very well in this bill. A cool $30 million for the Fitchburg commuter rail line, another $1.9 million for the parking lot at the Leominster station, and $950,000 for rail safety along the line top the list. Unfortunately Clinton, Sterling and Lancaster are not listed as recipients, but we don't have a lot in the way of federal projects in those towns.

(To digress for a moment, can someone try to remember the $1.5 million for the dams on the Wekepeke at some point in these processes? There wasn't even an effort to have it included in the stimulus package even though the project is the very definition of shovel-ready, as work was about to begin when Governor Patrick cut the funding as part of his 9C reductions. And there is plenty of money in this appropriations bill for mill pond restoration, dam repair, and other small-scale water management projects. Perhaps supporters of the Wekepeke will need to take the case directly to Representatives Olver and McGovern).

All told, the five representatives of my "home area"--John Olver (Sterling, Leominster) Jim McGovern (Clinton), Niki Tsongas (Lancaster) and Senators Kerry and Kennedy--have sponsored or co-sponsored $159,611,594 in appropriations.

Of that, a large portion of it is not for local earmarks, but rather for programs on a national scale. Nearly three-quarters of the $160 million are for programs such as the "Reading is Fundamental" program and the "We the People and Cooperative Education Exchange" that will be used in schools across the country. Almost all of the $120 million in national earmarks have broad bipartisan support, lest you think those programs are Democratic pet projects.

Looking at each of the representatives individually, John Olver is easily the biggest earmarker, with $38,862,472 targeted for community projects (not all in Central Mass.). Jim McGovern is responsible for $11,753,521 in community marks. Niki Tsongas is easily the least prolific earmarker, with only $3.3 million in sponsored projects, none in the Central Mass. area of her district.

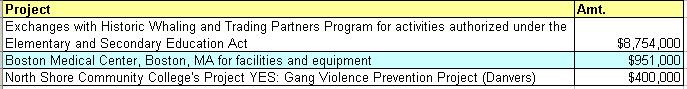

Regarding our senators, there is a very interesting dynamic in play. Nearly all of the 144 earmarks (129 local) that were sponsored by the senators were, in fact co-sponsored--that is, both Kerry and Kennedy signed on to the earmark. Kennedy only signed onto three earmarks without Kerry's support, they are:

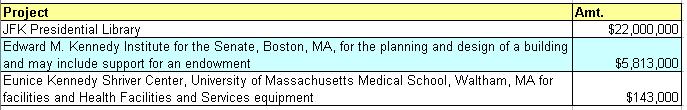

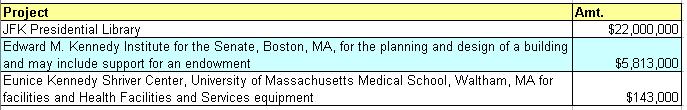

Kerry also only signed onto three earmarks without a co-sponsorship from Kennedy. See if you find the same humor in this list that I did:

That's right, the only three projects that Kerry supported without Kennedy's blessing are three projects named after members of Kennedy's family, including what looks to be the Ted KennedyPresidential Senatorial Library...which suggests that Teddy at least has the good sense not to earmark money for his own projects, unlike Charlie Rangel. Doesn't say much for John Kerry's independence though, does it?

A couple of other leftover points...lest anyone complain that this is an "Obama spending bill" it's important to remember that this bill was crafted during the last congress. Many of the sponsors are former members of congress from both parties. In researching the bills listed here, there were co-sponsorships from John Sununu, Christopher Shays, Joe Biden, and other former members of congress who have moved on.

Also interesting in light of that is that a number of the items in the appropriations bill were also sponsored by "The President," which means that the Bush administration was on board with these requests. Looking at the list of Massachusetts projects five of them were co-sponsored by President Bush, including the $30 million for the Fitchburg rail line, $5.6 million for operations at Boston Harbor, $4.9 million for Dam Construction on the Muddy River, $372,000 for construction of a hurricane barrier in Buzzards Bay, and $215,000 for a study of the Merrimack River watershed.

Tags: Massachusetts Congress Earmarks John Olver Jim McGovern John Kerry Ted Kennedy Leominster

Whether or not you think earmarks are necessary to get federal money to worthy projects or unnecessary pork to grease the palms of supporters--and there are probably plenty of examples of both--the fact is that they are there, and our representatives are pretty good at securing them.

Central Massachusetts looks to make out pretty nicely. Here is a list of the projects that will affect communities here in Worcester County:

The Twin Cities look to do very well in this bill. A cool $30 million for the Fitchburg commuter rail line, another $1.9 million for the parking lot at the Leominster station, and $950,000 for rail safety along the line top the list. Unfortunately Clinton, Sterling and Lancaster are not listed as recipients, but we don't have a lot in the way of federal projects in those towns.

(To digress for a moment, can someone try to remember the $1.5 million for the dams on the Wekepeke at some point in these processes? There wasn't even an effort to have it included in the stimulus package even though the project is the very definition of shovel-ready, as work was about to begin when Governor Patrick cut the funding as part of his 9C reductions. And there is plenty of money in this appropriations bill for mill pond restoration, dam repair, and other small-scale water management projects. Perhaps supporters of the Wekepeke will need to take the case directly to Representatives Olver and McGovern).

All told, the five representatives of my "home area"--John Olver (Sterling, Leominster) Jim McGovern (Clinton), Niki Tsongas (Lancaster) and Senators Kerry and Kennedy--have sponsored or co-sponsored $159,611,594 in appropriations.

Of that, a large portion of it is not for local earmarks, but rather for programs on a national scale. Nearly three-quarters of the $160 million are for programs such as the "Reading is Fundamental" program and the "We the People and Cooperative Education Exchange" that will be used in schools across the country. Almost all of the $120 million in national earmarks have broad bipartisan support, lest you think those programs are Democratic pet projects.

Looking at each of the representatives individually, John Olver is easily the biggest earmarker, with $38,862,472 targeted for community projects (not all in Central Mass.). Jim McGovern is responsible for $11,753,521 in community marks. Niki Tsongas is easily the least prolific earmarker, with only $3.3 million in sponsored projects, none in the Central Mass. area of her district.

Regarding our senators, there is a very interesting dynamic in play. Nearly all of the 144 earmarks (129 local) that were sponsored by the senators were, in fact co-sponsored--that is, both Kerry and Kennedy signed on to the earmark. Kennedy only signed onto three earmarks without Kerry's support, they are:

Kerry also only signed onto three earmarks without a co-sponsorship from Kennedy. See if you find the same humor in this list that I did:

That's right, the only three projects that Kerry supported without Kennedy's blessing are three projects named after members of Kennedy's family, including what looks to be the Ted Kennedy

A couple of other leftover points...lest anyone complain that this is an "Obama spending bill" it's important to remember that this bill was crafted during the last congress. Many of the sponsors are former members of congress from both parties. In researching the bills listed here, there were co-sponsorships from John Sununu, Christopher Shays, Joe Biden, and other former members of congress who have moved on.

Also interesting in light of that is that a number of the items in the appropriations bill were also sponsored by "The President," which means that the Bush administration was on board with these requests. Looking at the list of Massachusetts projects five of them were co-sponsored by President Bush, including the $30 million for the Fitchburg rail line, $5.6 million for operations at Boston Harbor, $4.9 million for Dam Construction on the Muddy River, $372,000 for construction of a hurricane barrier in Buzzards Bay, and $215,000 for a study of the Merrimack River watershed.

Tags: Massachusetts Congress Earmarks John Olver Jim McGovern John Kerry Ted Kennedy Leominster